What’s the Average Interest Rate on Student Loans?

The average student loan interest rate is 5.80%, according to a 2017 report by New America, a higher education policy think tank.

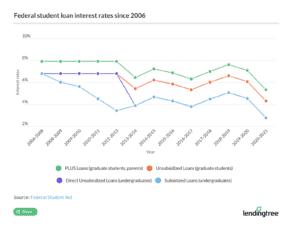

The true average interest rate on education debt is always changing, however, and has varied substantially due to many factors.

For instance, compare these average federal loan rates for the 2006-2021 period, which differ by loan type:

| Subsidized Loans (undergraduates) | 4.59% |

| Unsubsidized Loans (for undergraduates) | 4.46% |

| Unsubsidized Loans (graduate students) | 5.84% |

| PLUS Loans (graduate students, parents) | 6.85% |

The average private student loan interest rate, on the other hand, is even more fluid because each financial institution sets its own terms.

Here’s what you need to know about average loan rates and how they’ve changed over the decades — specifically:

What’s the average interest student loan rate?

When it comes to federal student loan interest rates, there technically is no “average” because rates are set by the government each year and do not change based on the characteristics of individual borrowers. This means there is just one set rate for each type of loan.

The average student loan rate varies only depending on the type of loan – including whether it’s a federal or private loan – and the type of degree.

The rates for private student loans, on the other hand, are determined by each lender and can vary depending on the qualifications of the borrower.

Average federal student loan interest rate

Federal student loans hit historic lows recently. In fact, the average student loan interest rate for the 2020-2021 academic year ranged from 2.75% to 5.30%, a significant drop from the year prior.

| Loan Program | 2019-2020 AY Rates | 2020-2021 AY Rates |

|---|---|---|

| Undergraduate loans (Subsidized and Unsubsidized) | 4.53% | 2.75% |

| Graduate loans (Unsubsidized) | 6.08% | 4.30% |

| PLUS Ioans (Parent & Grad) | 7.08% | 5.30% |

Average private student loan interest rate

The average private student loan interest rate is harder to pin down, as banks, credit unions and online companies set their terms independently. Each has its own criteria, though the typical student loan rates of all private lenders tend to drift in the same direction, according to market factors like the federal funds rate and the London Interbank Offered Rate (LIBOR).

Applying with a cosigner for private loans, when possible, can help borrowers qualify for the lowest advertised rates.

Since the offered rates depend on the borrower’s credit and other factors, the average might not be as instructive as the ranges. Here are examples of the ranges for fixed and variable interest rates advertised by private student loan companies:

| Lender | Fixed APR | Variable APR |

|---|---|---|

| Citizens Bank | 4.43% - 12.57% | 5.81% - 13.96% |

| CommonBond | 4.49% - 15.47% | 6.30% - 15.52% |

| SoFi | 4.24% - 13.13% | 5.24% - 12.88% |

| Digital Federal Credit Union (DCU) | 10.25% - 16.25% | 8.25% - 14.25% |

| College Ave | 4.07% - 15.48% | 5.59% - 16.69% |

| Sallie Mae | - | - |

| Wells Fargo | 4.99% - 10.72% | 4.33% - 10.30% |

| Navy Federal Credit Union | 5.50% - 13.30% | 7.72% - 17.16% |

| LendKey | 4.39% - 10.39% | 6.09% - 11.33% |

| Rhode Island Student Loan Authority | 4.40% - 8.45% | 0.00% - 0.00% |

| New Mexico Educational Assistance Foundation | 4.39% - 5.89% | 0.00% - 0.00% |

| MEFA | 5.35% - 7.95% | 0.00% - 0.00% |

Keep in mind that whether you’re borrowing federal or private loans, the average student loan interest rate differs from the average student loan APR. Unlike the simple rate, APR accounts for fees, such as the loan origination fees charged by Uncle Sam and some banks.

What were historical student loan interest rates?

Though the interest on your student loans can accumulate and make it harder to pay down the principal, average student loan interest rates are pretty low today by historical standards.

Student loan interest on federal loans is particularly low, thanks to a dip in the 10-year Treasury yields and authorization from the Congressional Budget Office. Before that, the federal funds rate hit zero because of the coronavirus pandemic’s effect on the economy at large in 2020.

Here are federal student loan interest rates by year:

Looking at the history of student loans, for a variety of reasons. Most recently, these highlights proved to be key:

| 2010 | In the wake of the Great Recession, lawmakers eliminated bank-based federal loans and made all loans available directly, lent by the Department of Education. The passage of the Health Care and Education Reconciliation Act (HCERA) allowed the government to set its own student loan interest rates. |

| 2013 | President Obama signed the Bipartisan Student Loan Certainty Act, which marked a change in how student loan interest rates are calculated. It also ended variable rates among federal loans. Four years later, Sen. Richard Burr (R-N.C.) said the law had saved borrowers $58 billion in student loan interest. |

| For more: The History of Student Loans and How It Affects You Today | |

What does the average student loan interest rate mean for you?

If you’re borrowing money for school, it’s important to understand how student loan interest works and to shop around for loans with the lowest rates possible to avoid spending more than necessary on your educational debt.

Federal loan interest rates adjust annually, though they rarely shift as drastically as they did for the 2020-2021 school year. Meanwhile, the best private student loans often have the lowest interest rates, but only the most creditworthy applicants qualify for them.

If you took out your loans years ago when interest rates were much higher, or at a time when your credit score was lower than it is today, it might be worth looking into ways to lower your interest rate so you could save money over time.

By refinancing your student loans to lower your interest rate, you could potentially cut your repayment costs significantly. Our student loan refinancing calculator can help you determine if you could save money by lowering your rate.

Of course, refinancing isn’t the best option everyone, so do your homework to find out if it’s a good solution for you. Start by reviewing the pros and cons of refinancing student loans.